Top Guidelines Of Property By Helander Llc

Top Guidelines Of Property By Helander Llc

Blog Article

Some Known Facts About Property By Helander Llc.

Table of ContentsThe smart Trick of Property By Helander Llc That Nobody is Talking AboutThe Ultimate Guide To Property By Helander LlcSome Known Details About Property By Helander Llc The 20-Second Trick For Property By Helander LlcThe Definitive Guide for Property By Helander Llc3 Simple Techniques For Property By Helander Llc

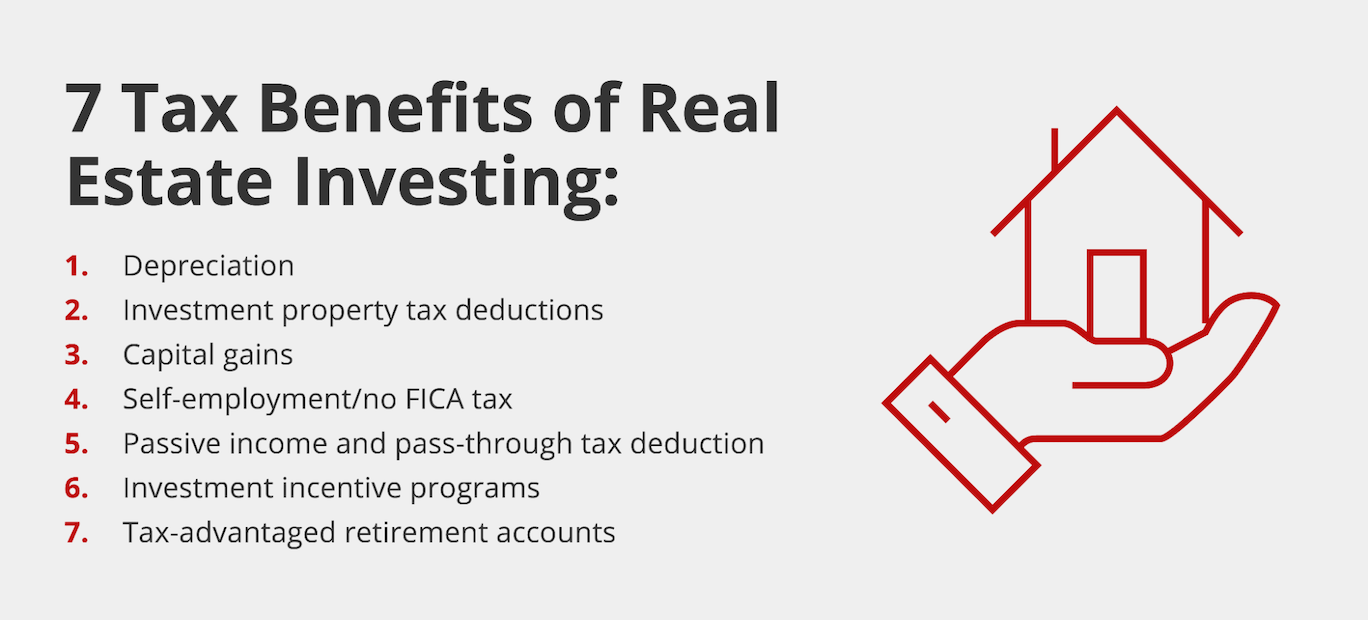

The benefits of investing in real estate are countless. Here's what you need to understand about real estate advantages and why real estate is taken into consideration an excellent financial investment.The advantages of purchasing realty consist of easy income, steady cash flow, tax benefits, diversity, and leverage. Actual estate investment company (REITs) use a method to purchase property without needing to have, operate, or money residential properties - (https://www.bark.com/en/us/company/property-by-helander-llc/akobBO/). Cash money flow is the net income from a realty financial investment after mortgage repayments and operating budget have actually been made.

In a lot of cases, capital just enhances gradually as you pay for your mortgageand accumulate your equity. Investor can benefit from numerous tax obligation breaks and reductions that can save cash at tax time. In basic, you can deduct the sensible costs of owning, operating, and managing a residential property.

Indicators on Property By Helander Llc You Should Know

Actual estate worths often tend to boost with time, and with a good financial investment, you can profit when it's time to sell. Rental fees additionally tend to rise gradually, which can cause higher money flow. This graph from the Reserve bank of St. Louis reveals typical home costs in the united state

The locations shaded in grey show united state economic downturns. Median Prices of Homes Cost the USA. As you pay for a residential or commercial property mortgage, you build equityan possession that belongs to your web worth. And as you build equity, you have the leverage to get more homes and raise capital and riches also more.

Since real estate is a substantial asset and one that can work as security, funding is easily available. Property returns vary, relying on elements such as place, possession class, and administration. Still, a number that many investors go for is to beat the ordinary returns of the S&P 500what lots of people describe when they say, "the market." The inflation hedging capacity of realty comes from the positive connection between GDP development and the need for real estate.

Fascination About Property By Helander Llc

This, subsequently, converts right into higher resources worths. Actual estate has a tendency to maintain the purchasing power of funding by passing some of the inflationary pressure on to renters and by including some of the inflationary pressure in the type of capital admiration. Mortgage lending discrimination is illegal. If you believe you have actually been differentiated versus based on race, religion, sex, marital condition, use public support, national beginning, impairment, or age, there are actions you can take.

Indirect realty investing involves no straight possession of a home or buildings. Rather, you buy a swimming pool along with others, where a monitoring business owns and operates buildings, or else has a profile of mortgages. There are several means that owning real estate can protect against inflation. Property worths might climb greater than the price of rising cost of living, leading to funding gains.

Lastly, buildings financed with a fixed-rate loan will certainly see the family member amount of the regular monthly home loan payments tip over time-- for example $1,000 a month as a fixed settlement will certainly become less More about the author troublesome as inflation deteriorates the purchasing power of that $1,000. Typically, a primary house is ruled out to be a realty financial investment considering that it is utilized as one's home

The smart Trick of Property By Helander Llc That Nobody is Discussing

Despite the aid of a broker, it can take a couple of weeks of job just to discover the appropriate counterparty. Still, realty is a distinct possession course that's basic to recognize and can improve the risk-and-return account of a financier's profile. By itself, realty supplies money flow, tax obligation breaks, equity structure, competitive risk-adjusted returns, and a hedge against rising cost of living.

Buying property can be an incredibly gratifying and profitable endeavor, however if you're like a whole lot of new financiers, you might be questioning WHY you need to be investing in genuine estate and what benefits it brings over various other financial investment chances. Along with all the remarkable benefits that come with buying realty, there are some disadvantages you need to think about also.

Rumored Buzz on Property By Helander Llc

If you're searching for a method to purchase right into the property market without needing to invest numerous hundreds of dollars, take a look at our homes. At BuyProperly, we make use of a fractional ownership version that permits investors to begin with as little as $2500. One more major advantage of realty investing is the capability to make a high return from buying, restoring, and marketing (a.k.a.

Everything about Property By Helander Llc

If you are billing $2,000 rent per month and you sustained $1,500 in tax-deductible expenditures per month, you will just be paying tax obligation on that $500 earnings per month (sandpoint idaho realtors). That's a big difference from paying taxes on $2,000 each month. The earnings that you make on your rental for the year is thought about rental revenue and will certainly be taxed accordingly

Report this page